By Dele Adeyinka

Through his pioneering and lead role at Polaris Bank where he is formulating and executing cutting-edge digital banking strategy, as well as in his previous role at Wema Bank, he has impacted significantly on customer acquisition and contributed to the growth in depositors’ funds of the two banks over the past few years.

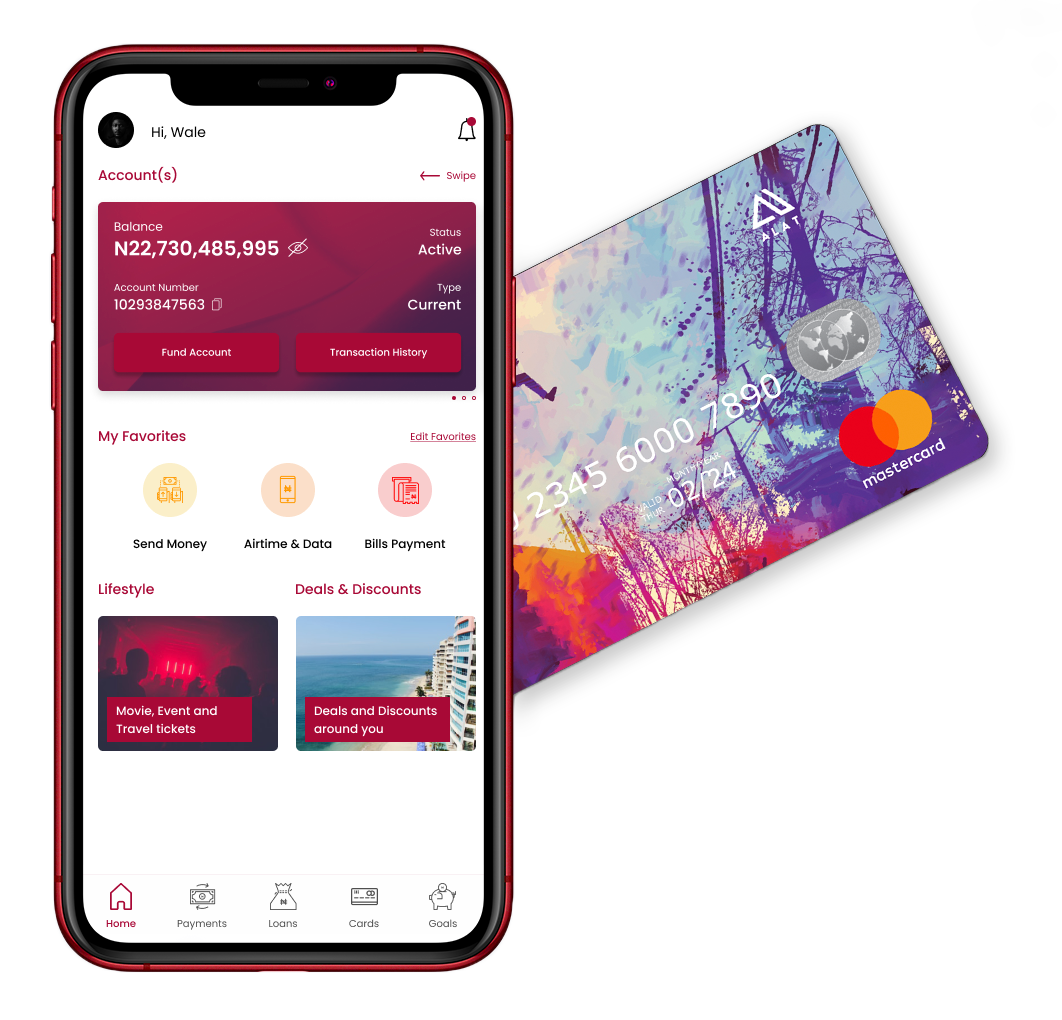

Dele Adeyinka is the first Chief Digital Officer to build the first fully digital bank in Nigeria – ALAT by Wema, and the first CDO to lead a team of indigenous IT experts of a Nigerian bank to develop the country’s premier and first full home-grown digital bank solution, VULTe by Polaris Bank.

His pioneering role and bold signature on Nigeria’s digital banking landscape are quite striking.

As the Divisional Head, Digital Bank/Chief Digital Officer at Polaris Bank, he led the bank’s Digital Banking and Information Technology teams which successfully developed VULTe as Nigeria’s premier home-grown digital bank not outsourced to any external expert.

YOU CAN ALSO READ: Should The Next President Expect Votes From Fintech Ecosystem?

Polaris Bank’s VULTe is also the first digital bank in Nigeria with the highest customer enrolment and fastest by acquisition having achieved one-millionth downloads in just four months of its launch, erasing the record ever achieved by any traditional or digital bank in the history of banking in Nigeria.

Through his pioneering and lead role at Polaris Bank where he is formulating and executing cutting-edge digital banking strategy, as well as in his previous role at Wema Bank, he has impacted significantly on customer acquisition and contributed to the growth in depositors’ funds of the two banks over the past few years.

As Polaris Bank’s Divisional Head of Digital Bank with oversight for coordinating three business units comprising e-Business, Digital Bank & Agency Banking, the Digital Banking Group, contributes exponentially to customer acquisition and accounts for about $10.9bn pool to the bank’s depositor funds with a projection to double it in the next two to three years.

VULTe by Polaris Bank and ALAT by Wema Bank, which he pioneered their rollouts have equally won notable industry awards, accolades, and recognitions. These include VULTe winning the ‘Best Digital Bank’ award at the 2021 and 2022 editions of BusinessDAY’s Banks And Other Financial Institutions (BAFI) Awards, and the ‘Best Digital Bank’ at The Nigerian Fintech Awards 2022 respectively.

In the previous years and up till the present, ALAT, which he incubated while at Wema Bank, has also been named the ‘Best Mobile Banking App’ and ‘Best Digital Bank’ respectively at the World Finance Digital Banking Awards 2017. ALAT also emerged as the ‘Best Digital Bank’ at the 2018 Africa Tech Summit.

YOU CAN ALSO READ: Despite High Inflation, Americans Spend $26 Billion on Valentines

A consummate cross-disciplinary professional committed to excellence, his qualifications and experience span e-Business, digital banking, innovation, fintech, and data analytics, while he plays strategic roles through major career blocks as he builds himself for top-level managerial positions in his chosen career path.

In his about three decades of post-graduation work experience, Dele has built competencies in technical, managerial, and accounting-related responsibilities and excelled favourably in numerous tasks and projects that he has led and co-managed with others. His wealth of experience enhances the efficiency, productivity, and profitability of his various teams and projects – VULTe and ALAT digital bank solutions are signature proofs of this fact.

At various times, he has held strategic positions including his current position as Divisional Head, Digital Bank/Chief Digital Officer at Polaris Bank, where he drives digital innovation, business management, and technology leadership.

In his almost 13 and half years stint at Wema Bank, he served as the Chief Digital Officer where he disrupted Nigeria’s bank ecosystem with the launch of the pioneer digital bank ALAT by providing a new way to banking. By designing, optimising and driving the implementation of the digital roadmap end-to-end across the board, he supported the bank to onboard over 200,000 customers in eight months with over $2.8m average on deposit and over $39.1m in transactions.

As the Wema Bank’s Head of E-Business & Payments, prior to his elevation as the CDO, Dele brought his expertise to bear by developing and implementing an excellent go-to-market strategy to increase the rollout of the bank’s payment cards, ATMs, electronic channel products, and other technology-enabled products and services. He also led a strategic business unit that achieved a yearly $2.6m revenue.

At Access Bank where he served as the Team Lead, of e-Business & Payments, he effectively led the development and deployment of e-Business solutions across the bank’s branch network in Nigeria and regional subsidiaries in The Gambia, Sierra Leone, Burundi, Congo DRC, Zambia, and Liberia. He also implemented and managed portal solutions for several corporate clients.

He was also Head of IT and Products Development at Toyota Motor Corporation responsible for setting up and managing the company’s state-of-the-art data center, as well as implemented the switching solutions for Card Management Systems, Terminal Management Systems, Card Personalisation and Production Systems involving several Nigerians banks, foreign partners and Nigerian Inter-Bank Settlement System (NIBSS).

Additionally, Dele’s digital footprints include being the Chairman of the Committee of e-Business Industry Heads (CeBIH). Constituted of the upper echelon of electronic business industry practitioners in all banks in Nigeria, its main objective is the promotion of electronic banking services in line with global best practices, whilst driving its adoption through the right policies, standards, technologies, and public awareness programs in Nigeria.

YOU CAN ALSO READ: JCI Uyo City Donates Baby Items To Babies of The Year, Rewards Mothers with Cash

His numerous educational and professional qualifications include; a B.Sc in Chemistry; Masters in Business Administration (MBA, Accounting & Finance); a Senior Management Programme (SMP) from the Lagos Business School, a Chartered Accountant and a member of the Institute of Chartered Accountants of Nigeria (ICAN); Executive Program at the Judge School of Business, University of Cambridge; Postgraduate degree from Emeritus, and Executive Education at INSEAD.

Dele Adeyinka’s pedigree as an engineer of digital banking solutions can, without a doubt, be attributed to his deep hunger for knowledge.

In his portfolio are numerous vast ICT certifications including Microsoft Certified System Engineer (MCSE) -Certified E-Business Consultant (CEC) as issued by the International Council of Electronic Commerce Consultant in the UK -PRINCE2 Certified Professional which strengthens my professional skills in Project Management methodology widely used in the UK -Oracle 10g Certified Associate (OCA) and an -Oracle 10g Certified Professional (OCP) which consolidated his skills in Relational Database Management Systems (RDBMS) having worked extensively with several Microsoft products and operating systems.

Do you want us to share your enterprise and brand stories to the world on our platform for effective business leads and returns?

Kindly call this number, +2348063450905 or send an email to news@enterpriseceo.ng.

We will be glad to tell your impact stories.

Follow enterpriseceo.ng on Twitter and Facebook to join the conversation.